This blog will review the real cost of CEBA refinancing alternatives. Unlike the CEBA loan itself, which was offered uniformly to all Canadian businesses, the best CEBA refinancing options will be personalized to you. By understanding the details of the cash flow and total cost of borrowing, you can make a more informed decision about repaying your loan and better prepare for your business’s future.

With up to $20,000 in loan forgiveness on the line, many SMBs are looking for ways to take advantage of government incentives. According to the CEBA loan agreement, if the company does not have the funds to repay the CEBA loan before the deadline, refinancing may be the best option. However, no one solution is best for all businesses: when in doubt, contact your financial institution.

There are a few technical terms in this blog. A very good tool for explaining the terms is Investopedia. Keep this resource in mind as you consider the following options:

CEBA Repayment Alternatives

There are four primary repayment options available to any business. Business owners should consider at least a few of them. By comparing the cost of continuing with the CEBA loan and not taking advantage of the government forgiveness compared to taking out a loan to replace the CEBA loan, business owners can see the full impact of the loan repayment on the business operations and the total cost of financing. The four alternatives that we’ll review are:

- Continue with the CEBA loan”

- Bank or Credit Union financing

- Alternative Lender Financing

- Other forms of financing

Assumptions

In order to have a level playing field, we have made a number of assumptions to cover the most likely outcomes for SMB

- The company has a $60,000 CEBA loan

- The company is in good standing and qualifies for $20,000 loan forgiveness

- The company will apply to their financial institution for a loan before January 18, 2024 (this is important because it moves the repayment deadline to qualify for loan forgiveness to March 28, 2024).

- The interest payments will be for a full month, even if in reality there are some periods that are a bit less or a bit more than a month

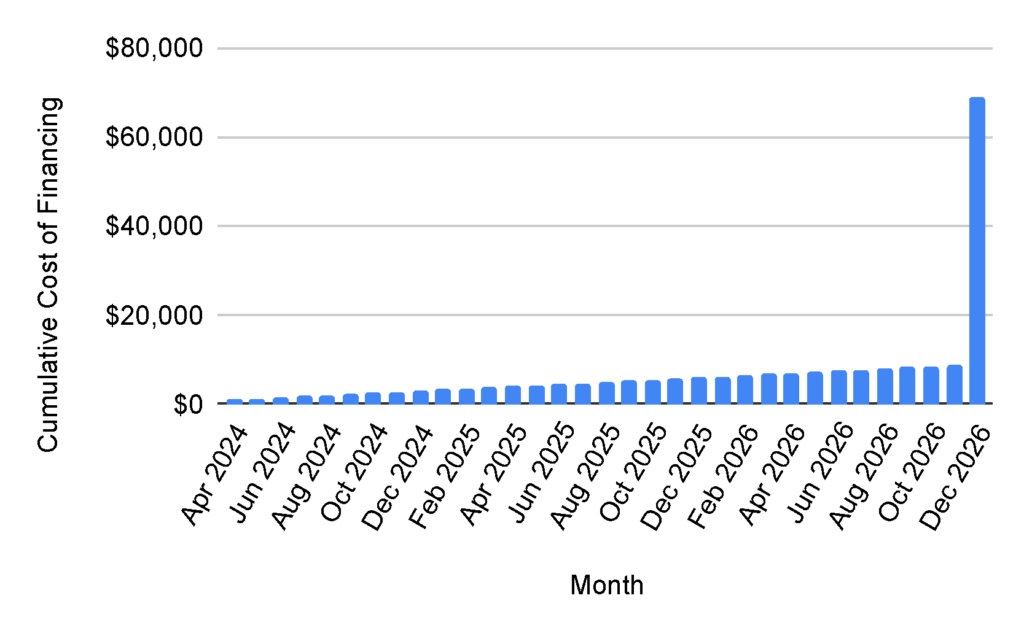

Continue with the CEBA loan

This may seem like the default for many borrowers as it is the “do nothing” alternative. However, let’s look at the cost of this option. The loan will be held from April 2024 through to December 2026 for a total of 33 months. The interest rate is 5.0% per year. Therefore, each month the payment to the financial institution is $250.00 ($60,000 x 5.0% ÷ 12). As a result, the total cost is $60,000 + $250 x 33 months = $68,250.

The biggest benefit of this option is the low monthly costs. Paying $250.00 per month is appealing to many; however, at some point before December 31, 2026, the full principal of $60,000 needs to be paid.

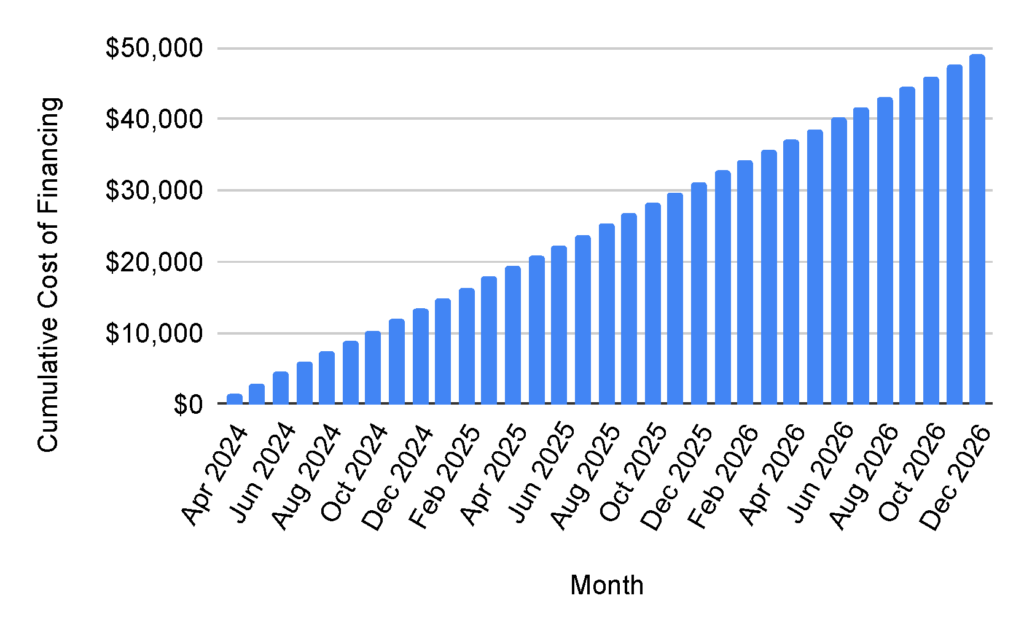

Bank or Credit Union Financing

If a company has a strong credit rating, it’s likely that it qualifies for bank or credit union financing. This financing allows companies to take advantage of government forgiveness – meaning they don’t need to repay the $20,000 forgivable portion of the loan – as well as pay a relatively low-interest rate. There will most likely be a small fee to set up the loan and then monthly payments that amortize the loan over a 33-month period. The company will pay the same amount each month so that by month 33, the entire loan will be repaid. This is called an amortizing loan.

Note that because it is a $40,000 loan, the interest rate is higher than 5%, but the cost is still less than a $60,000 loan. The loan forgiveness portion gives this option a ‘head start,’ although the interest rate the banks charge will vary depending on the credit of the company. The rate could be as low as 9.5% and as high as 19%. For illustrative purposes, we have chosen a rate of 15% and monthly compounding. The total interest paid is $9,061.58, and with the principal of $40,000, the total paid is $49,061.58. Each month, a business would pay almost $1,500.

This option is the least expensive of the three: even with the example interest rate of 15%, triple the 5% rate on your CEBA loan, you can still save more than $10,000. However, it does require a payment of almost $1,500 per month, which could hurt your current cash flows In the end, though, it will save the company over 19,000 relative to continuing with the CEBA loan.

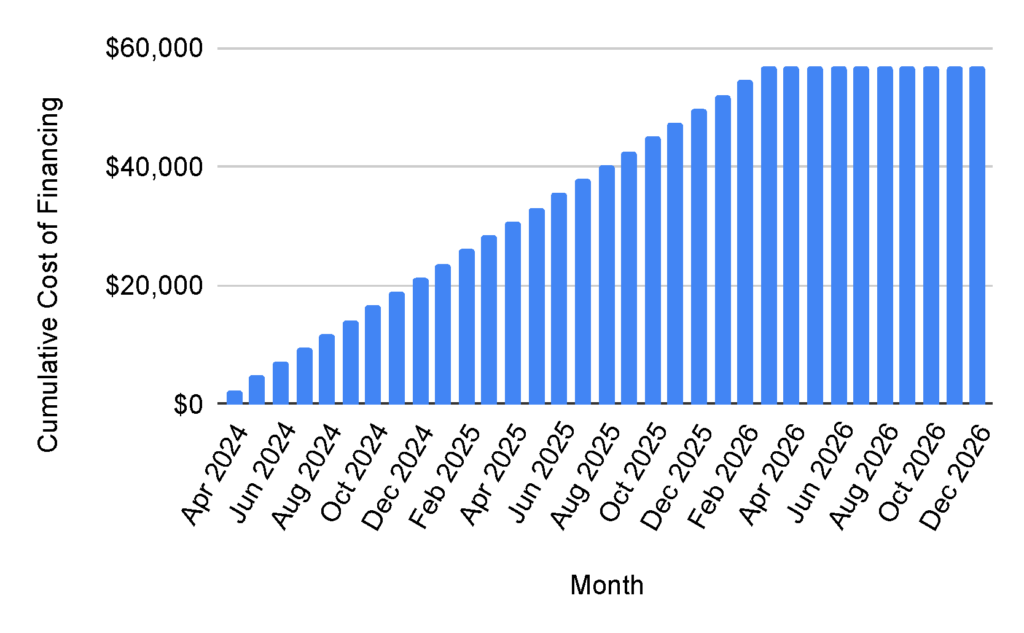

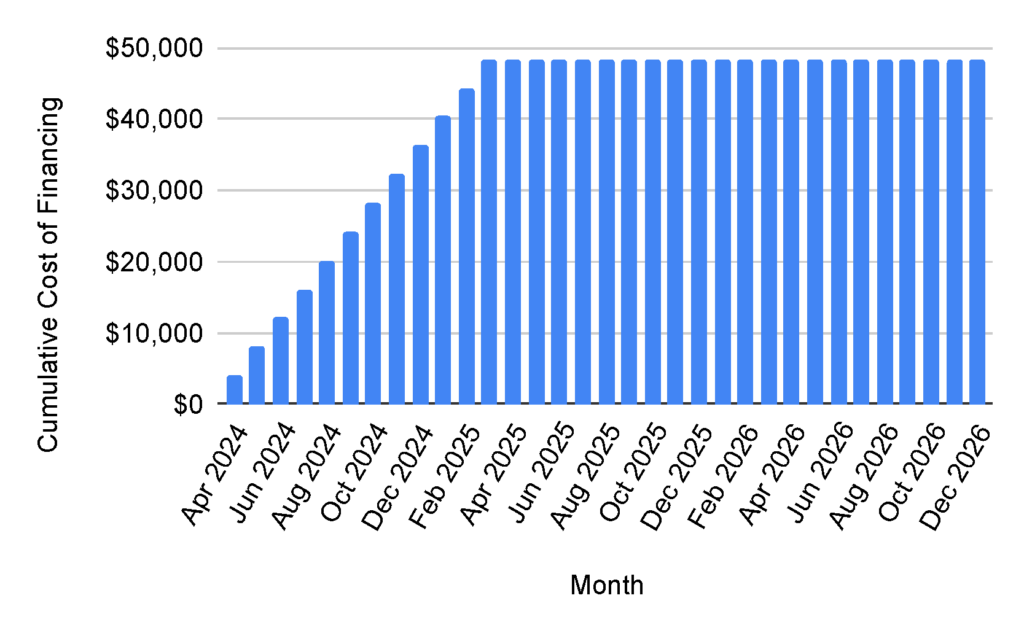

Alternative Lender Financing

Many SMBs will not qualify for bank financing – but if the companies are good businesses with employees, revenue and a good reputation, they still may have options for a loan. Alternative financing specializes in funding SMBs. It’s, therefore, an excellent option for businesses looking to refinance their CEBA loans.

Alternative financing works differently from banks and credit unions in that they have a factoring rate and often require weekly payments. The factoring rates vary between 1.15 and 1.40 depending on the credit score of the company and the owner(s). For illustrative purposes, we have assumed a factor rate of 1.21, which is an average rate.

The other main difference from banks is that alternative lenders will typically lend for a 12 or 24-month period and in rare circumstances for 36 months. This means monthly payments can be higher, but on the other hand, you can pay down the loan faster, becoming debt-free in 24 months instead of 33.

The first example assumes a 24-month term. In this case, monthly payments would be about $2,400 and the total cost of the loan would be $56,800. This is a $11,450 savings over continuing with the CEBA loan.

For a one-year term, the monthly payments are just over $4,000, and the total paid is $48,400. This is a savings over continuing with the CEBA loan of almost $20,000. While this option is the lowest total cash out the door, the business needs to have the ability to repay $4,000 per month – which isn’t easy for many of the Canadian businesses hardest hit by the pandemic.

Other forms of financing

The options above are discrete alternatives. However, companies may elect to use a combination of existing cash plus financing to refinance their CEBA loan. Refinancing CEBA makes sense in almost all circumstances: a $20,000 head start beats out all but the highest of interest rates. If a business owner can borrow personally, either from an institution or friends and family, this may be sufficient to refinance the CEBA loan. Another alternative to finding the funds for refinancing CEBA is to sell equity in the company to raise cash. This can take an extended period of time and, therefore should be initiated as early as possible.

The Real Cost of CEBA Refinancing Alternatives: Summary

Business owners have a number of options to refinance CEBA loans. The illustrative table below summarizes the monthly payments (cash flow impact) and the total cost of refinancing.

| Option | Term (months) | Monthly Payments | Total Payments | Credit Needed |

| Continue with CEBA | 33 | $250 | $68,250 | None |

| Bank or Credit Union Financing | 33 | $1,500 | $49,000 | Good to Very Good |

| Alternative Lender Financing | 24 | $2,400 | $56,800 | Poor to Good |

| Alternative Lender Financing | 12 | $4,000 | $48,400 | Poor to Good |

It is important to talk to your financial institution regarding CEBA refinancing options. There may be options available to suit your specific needs. The examples that are shown are purely illustrative but should provide you with guidance on the differences between the CEBA refinancing alternatives and the cost of continuing with the CEBA loan. Typically, your financial institution will provide the best alternative: your business does not qualify for bank financing, and alternative lenders offer a significantly lower total cost overall relative to continuing with the CEBA loan.