The Canada Emergency Business Account (CEBA) is an initiative of the Government of Canada. The official Government website is ceba-cuec.ca

The Refinace Meter shows how likely you are to receive a loan from this financial institution. It assumes that you don’t have the money to repay the loan and have an average credit score.

If you don't have the funds to repay the CEBA loan by January 18,2024, to qualify for the loan forgiveness, Toronto-Dominion Bank TD will consider extending a business loan to customers that meet their credit criteria.

1. Log into TD EasyWeb at https://easyweb.td.com/

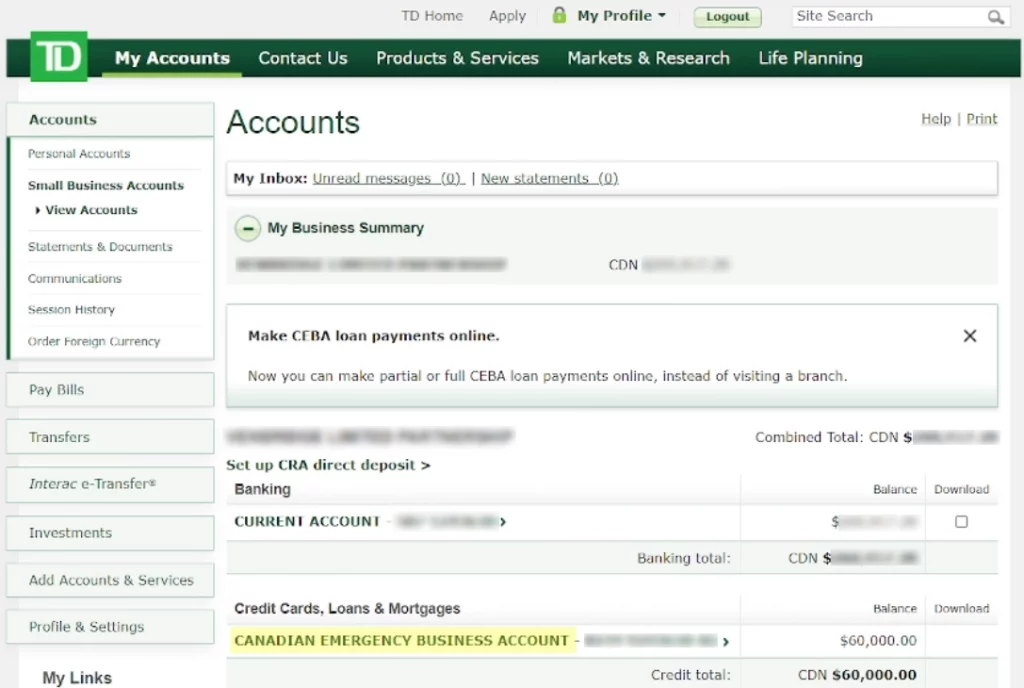

2. Under the Accounts section Select your Business Account or Small Business Account that has the CEBA loan

3. Scroll to the bottom of the screen to view the “Credit Cards, Loans & Mortgages” section.

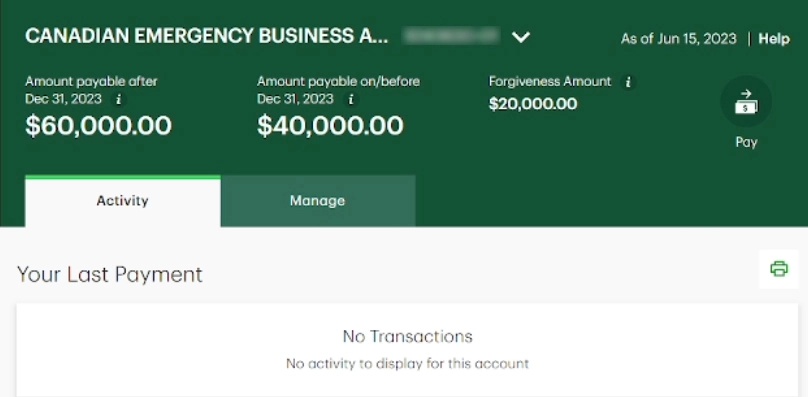

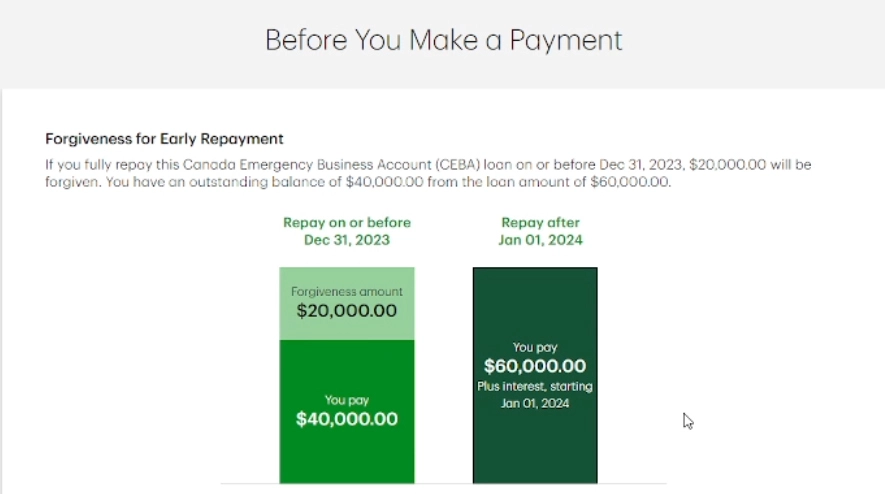

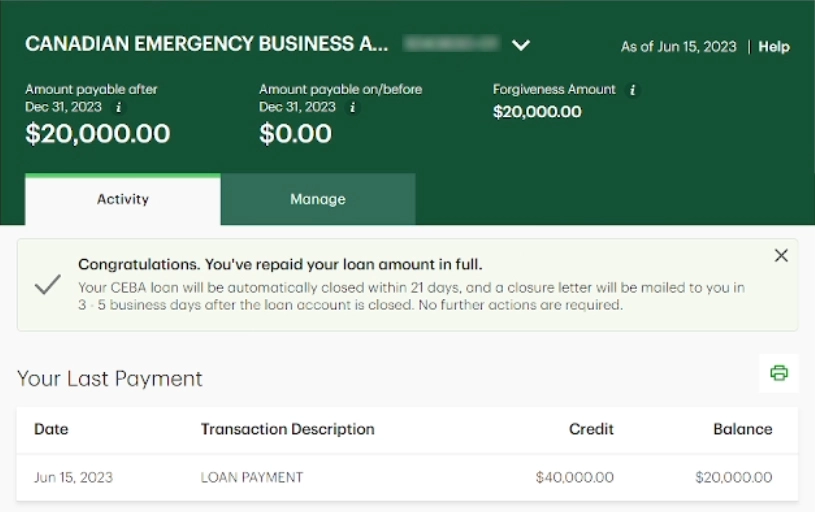

5. This screen will show you the details of your CEBA loan. In this case, the company has a $60,000 CEBA loan. It specifies that the Amount payable on or before Dec 31, 2023 is $40,000 and the forgiveness if paid by then is $20,000. If you click on the “Activity” tab it shows all loan payments made to date.

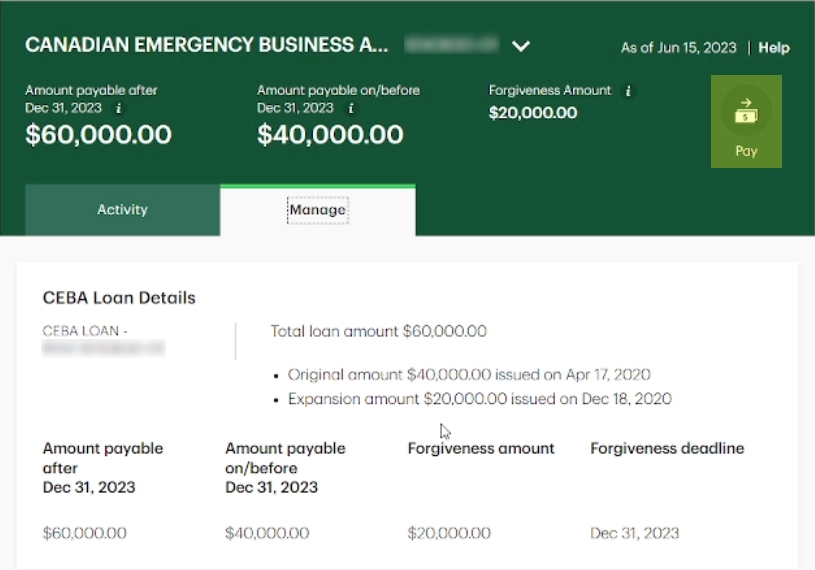

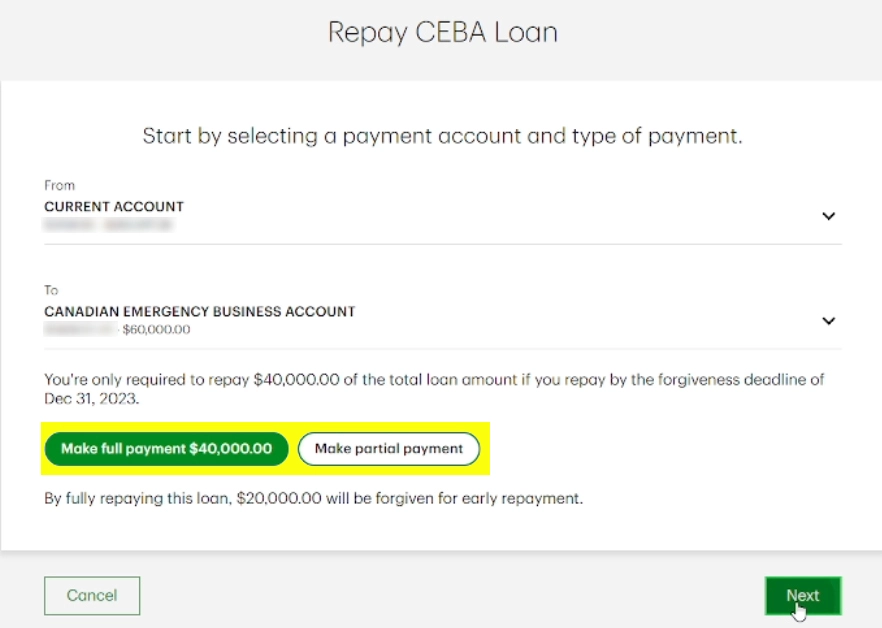

6. If you click on the “Manage” tab it provides some detail on when the original loan was taken, when the expansion CEBA loan was taken and the amounts. To fully repay the CEBA loan or make a payment towards the CEBA loan click on “Pay” on the top right-hand side of the screen.

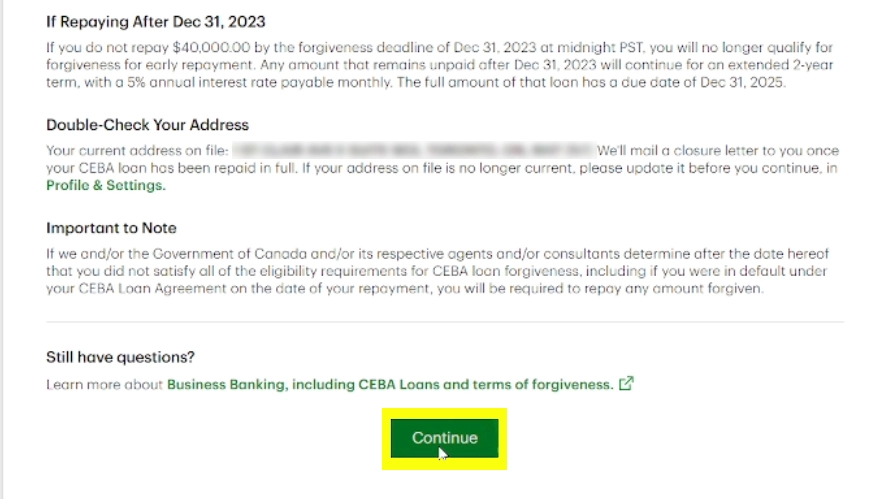

7. TD Bank then provides details of the repayment. The goal is to ensure that you are fully aware of the terms of the loan.

8. Scroll to the bottom of the screen, ensuring you double-check your address and click “Continue”

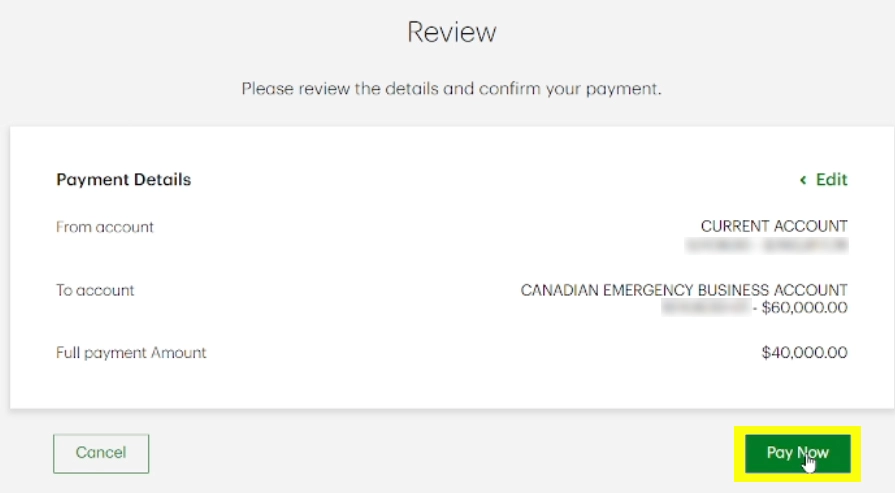

10. If full payment is selected, a verification screen allows you to double-check that the information you selected is correct. If it is, click “Pay Now”

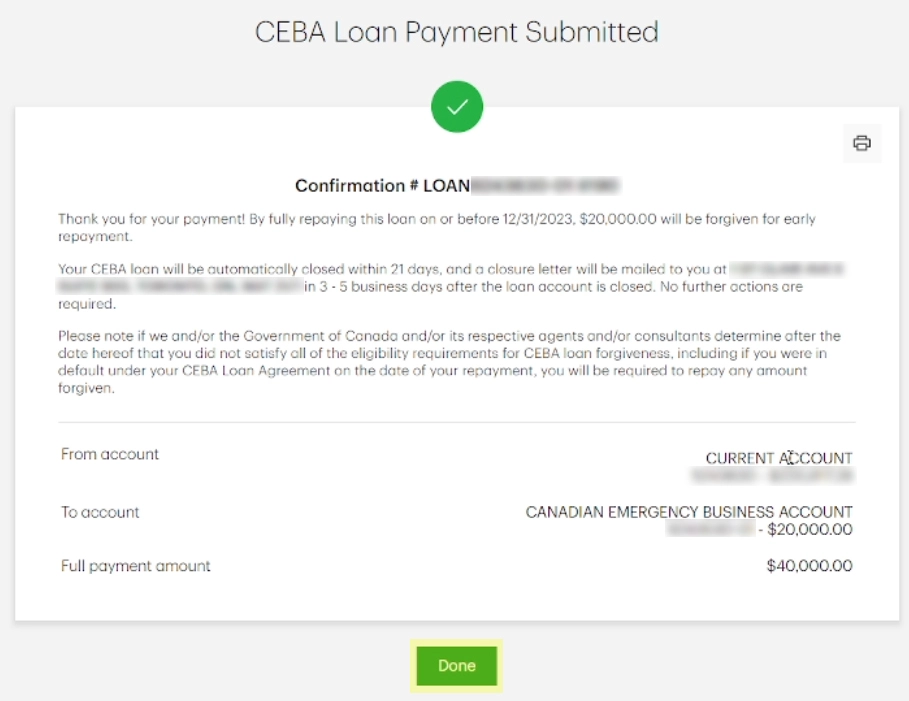

11. If successful, a CEBA Loan Payment Submitted screen shows the full payment amount. Simply click “Done” to finish the transaction.

12. In the middle of the screen, TD Bank notifies you that “Your CEBA loan will be automatically closed within 21 days, and a closure letter will be mailed to you in 3 – 5 business days after the loan account is closed. No further actions are required.” You may want to click on the printer icon to print this screen for your records.

This website uses cookies to provide necessary site functionality and improve your online experience. We never collect any personal data. By using this website you agree to the use of cookies as outlined in our Cookie Policy